Any business that has at least two owners can be a partnership. However, from a legal perspective, forming a partnership involves making key decisions early on about what kind of business you want to be. The key question you have to answer is which of the four types of partnerships is right for you.

Limited partnership (“LP”) is nothing more than a specific variation. The key difference between an LP and a general partnership (“GP”) is the concept of “limited partners” versus “general partners”. In an LP, the general partners are the ones with everything on the line. They make the business decisions, but they are also exposed to personal liability for financial and legal obligations of the business. Limited partners on the other hand do not share in these risks. This can be a big bonus for the business because it can help lure passive investors to contribute.

However, even an LP carries some similar drawbacks as a GP. If gridlock develops between the general partners or a general partner passes away, the LP is still terminated. Again, transfers of ownership are also not permitted.

At Garrett, Walker & Aycoth, we can walk you through the benefits and risks of establishing your business as a limited partnership. Our attorneys have the knowledge and skill required to help you determine whether a LP is best option for you and to advise you on how to avoid common pitfalls associated with such a partnership type. Call us today at (336) 379-0539 or contact us to schedule an in-depth consultation.

BUSINESS LAW POSTS

The Greatest Homecoming on Earth Returns!

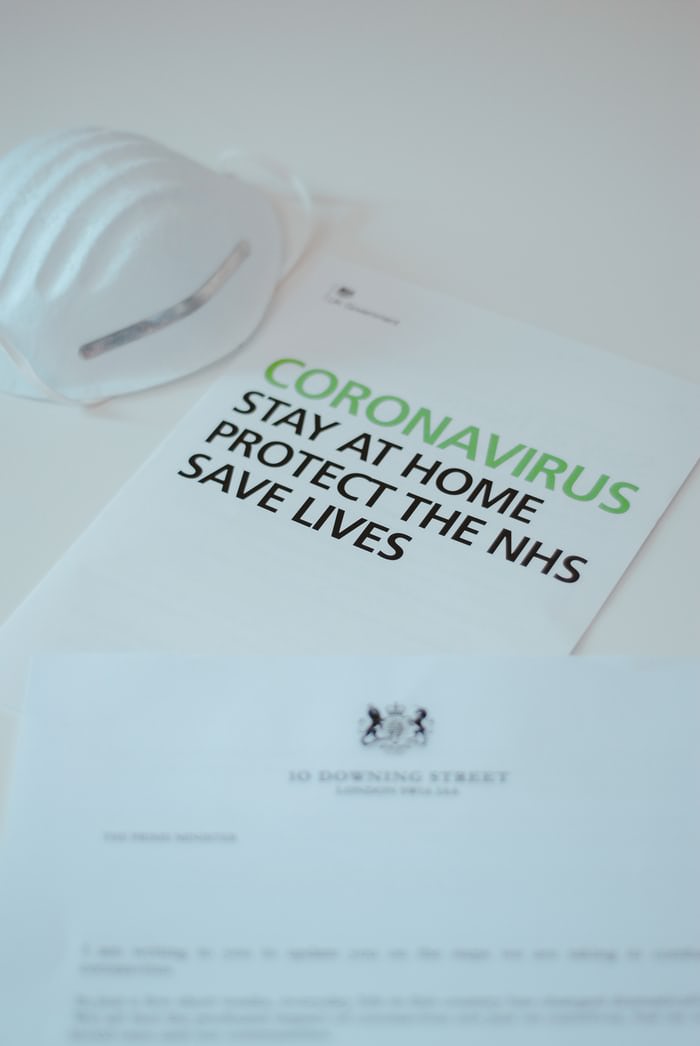

July 13, 2021Attorney in Greensboro COVID-19 caused a lot of change to our world both nationally and locally. Last year the Greatest Homecoming on Earth, GHOE was cancelled due to the pandemic. ...

Greensboro Businesses now considered Essential after Appeal

April 21, 2020After appealing the stay at home order a number of Greensboro businesses have been allowed to reopen. Businesses that had appealed their non-essential designation have been delighted to find that ...

Simulus Money going to Tax Preparers

April 17, 2020So as if the stimulus checks weren’t needed days ago, now there appears to be yet another issue according to our Greensboro Attorney. If someone prepared your taxes, chances are ...

Greensboro attorney is advised that some Truck Drivers don’t feel welcome

April 9, 2020Without truck drivers, there’s no telling where we’d be. Truck drivers are the people we depend on to move all sorts of equipment, food, medical supplies, you name it. Our ...